EmoGuardian The Ultimate EA for Emotions-Free Trading

Fear, greed, anxiety, frustration, anger, regret, overwhelm

Tired of the emotional rollercoaster of trading?

When emotions dominate and lead to impulsive behaviors, they can cloud judgment and result in costly mistakes, ending a trading career in just a matter of days.

Common psychological biases can play a significant role in trading decisions and hence is crutial to develop awareness of one’s emotional tendencies in order to develop a well-defined plan and sticking to a rational decision-making process.

The key is to rely on an efficient risk management tool that helps you to develop a rational approach towards trading.

Simplify your risk management; embrace clarity and consistency.

Emotions

Under Control

Institutions have dedicated risk managers to prevent catastrophic losses. The distinction between trader and risk manager is where the dealing desk has the real advantage over the independent trader.

The good news is that technology now allows discretionary traders to focus on their trades, delegating risk management to software tools.

You are 3 steps away to consistency

1. Insert the risks parameters

2. Update the risks parameters

3. Activate Emo Guardian

"Emotions like fear and greed can lead to impulsive decisions, while overconfidence can result in excessive risks and losses (...) mastering emotions and overcoming biases are the keys to success"

------------------------------------------------------------

"Consistency is the most important single aspect of trading (...) your success as a trader is determined by the degree to which you can manage your emotions"

------------------------------------------------------------

"If you can control your behavior when everything around you is out of control, you can control your destiny (...) so learn to be patient and disciplined"

------------------------------------------------------------

EmoGuardian use Cases

These are some “case studies” of how to use EmoGuardian.

Besides being useful in one’s personal trading account,

EmoGuardian is the perfect tool for a prop firm trader.

Emotions Management

Learn how EmoGuardian can be use to tackle the most common emotional behaviors that jeopardize a traders career

The 1% prop firm rule

Many Prop Firms are now enforcing a max risk per trade rule. Learn how to avoid risk warnings using EmoGuardian

Boom and Bust traders

Learn how to stop the vicious boom and bust cycle and grow your trading potential

Prop Firms application

EmoGuardian is perfect to avoid violating the risk management rules imposed by propfirms.

Darwinex case study

Learn how to grow your Darwinex Zero multiplicator by setting up the correct risk parameters in EmoGuardian

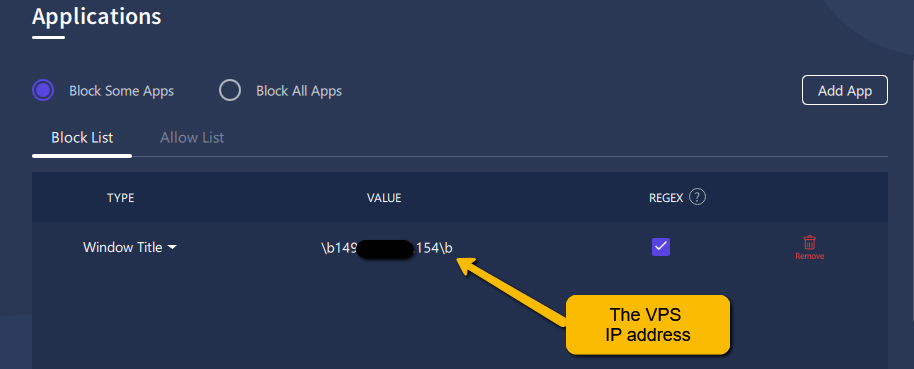

EA management

Learn how to use EmoGuardian to manage EAs and avoid losing accounts in case of EAs malfunctioning.

Knowledge Center

FAQ

Check out our FAQ or get in touch with us

This EA helps you hone your discipline and embrace a careful mindset in your trading journey. It will help you to protect your capital by setting precise limits based on your requirements and your trading plan, ensuring a steady path to consistent gains and unwavering confidence in your trading endeavors.

Sure! you can contact the develper by joining our Discord server (use this link ) and we will be glad to provide a free demo version.

Most of the Prop Firms allow the use of EAs that are categorized as “utility”. However we suggest to check with each Prop Firm if the use of EAs is allowed.

Disclaimer

Trading products carries a high degree of risk and you could lose more than your initial deposit. Any opinions, chats, messages, news, research, analyses, prices, or other information contained on this Website are provided as general market information for educational and entertainment purposes only, and do not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. Emo Guardian will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information and our product.

We do not recommend the use of technical analysis as a sole means of trading decisions. We do not recommend making hurried trading decisions. You should always understand that PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS