One of the most effective ways to mitigate overtrading and maintain a disciplined behaviour approach is by setting stop-loss and take-profit orders. These predefined exit points help traders manage risk and secure profits, ensuring that trading decisions are guided by strategy rather than emotion. Here’s how traders can successfully set stop-loss and take-profit orders to keep their emotions in check.

Understanding Stop-Loss and Take-Profit Orders

- Stop-Loss Order: A stop-loss order is an instruction to sell a security when it reaches a certain price, limiting the trader’s loss on a position. It acts as a safety net, protecting against significant losses during unexpected market movements.

- Take-Profit Order: A take-profit order is an instruction to sell a security when it reaches a predetermined profit level. This helps traders lock in gains and avoid the temptation of holding onto a position for too long in the hope of higher profits, which can lead to potential reversals and losses.

Setting Effective Stop-Loss Orders

- Determine Risk Tolerance: Before setting a stop-loss, a trader must assess their risk tolerance. This involves deciding how much of their capital they are willing to risk on a single trade, typically expressed as a percentage of the trading account (e.g., 1-2%).

- Identify Key Support Levels: Analyze the chart to identify key support levels, which are price points where the security has previously found buying interest. Placing a stop-loss slightly below these levels can provide a cushion against temporary price dips.

- Use Technical Indicators: Utilize technical indicators such as Moving Averages or the Average True Range (ATR) to set stop-loss levels. For example, a stop-loss can be set a certain percentage below a moving average line or a multiple of the ATR to account for market volatility.

- Avoid Emotional Adjustments: Once a stop-loss is set, resist the urge to adjust it based on emotional reactions to short-term price movements. Adjustments should only be made based on new technical or fundamental analysis.

Setting Effective Take-Profit Orders

- Set Realistic Profit Targets: Based on historical price movements and market analysis, set realistic profit targets. Using tools like Fibonacci retracement levels or resistance levels can help identify potential take-profit points.

- Risk-Reward Ratio: Ensure a favorable risk-reward ratio, typically aiming for at least a 1:2 ratio. For instance, if your stop-loss is set to risk 50 pips, aim for a take-profit of at least 100 pips.

- Analyze Market Conditions: Consider the current market environment when setting take-profit levels. In a trending market, you might set a more ambitious target, whereas in a range-bound market, it might be prudent to set a more conservative target closer to resistance levels.

- Partial Profit Taking: Sometimes, it can be beneficial to take partial profits at intermediate targets while leaving the rest of the position open for potentially larger gains. This approach allows you to lock in some profits while still participating in further market movements.

Combining Stop-Loss and Take-Profit Orders

- Balanced Approach: Use both stop-loss and take-profit orders in conjunction to ensure a balanced approach. This combination helps manage risk and secure profits, maintaining a disciplined trading strategy.

- Consistent Application: Apply these orders consistently across all trades to maintain a systematic trading approach. Consistency helps to avoid emotional decision-making and ensures that your trading plan is adhered to.

- Regular Review: Periodically review and adjust your stop-loss and take-profit levels based on evolving market conditions and new analysis. However, ensure that these adjustments are based on rational analysis rather than emotional reactions.

Leveraging Automated Trading Systems

Automated trading systems, or trading expert advisors, can be particularly effective in managing stop-loss and take-profit orders. These systems execute predefined rules without emotional interference, ensuring that trades are closed according to plan. Here’s how automated systems can help:

- Emotion-Free Execution: based on predefined criteria, eliminating the impact of emotions such as fear and greed on trading decisions.

- Consistent Strategy Implementation: Automated systems consistently apply your stop-loss and take-profit levels across all trades, ensuring adherence to your trading plan.

- Speed and Precision: Automated systems can react to market movements faster than a human, ensuring that orders are executed at the exact predefined levels.

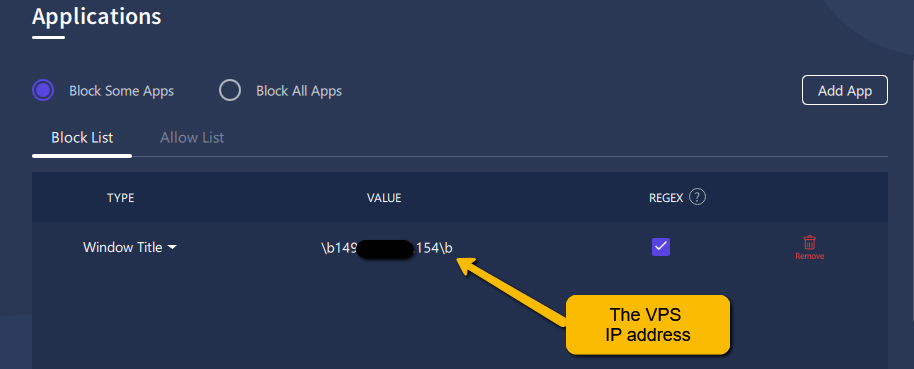

- Set Automatic Stop Loss in Percetange of Account Balance or in Pips.

Setting stop-loss and take-profit orders is a fundamental aspect of disciplined trading, helping to manage risk and secure profits while mitigating emotional influences. By determining risk tolerance, identifying key support and resistance levels, using technical indicators, and leveraging automated trading systems, traders can maintain a rational and systematic approach. Consistently applying these strategies ensures that trading decisions are guided by data and analysis, rather than emotions, leading to more stable and successful trading outcomes.