If you are an Indian trader you might be wondering why you cannot trade with some of the biggest (and safest) prop firms like FTMO.

Since 2018 the Reserve Bank of India (RBI) decided to regulate the financial system and put in place a framework for authorization of electronic trading platforms (ETPs). This was followed by a list of authorised ETPs that are the only ones allowed to operate in the financial sector in the country.

Subsequently the RBI started to release an “Alert Lis” of unauthorised ETP, that included several major brokers, financial institutions, trading platforms and even several prop firms. The list included brokers such us IC Markets, Avatrader, IG Markets, Think Markets; trading platforms like eToro, Metatrader 4 and Metatrader 5 and several prop firms, among which FTMO and FundedNext. You can check the full list at this link (https://rbi.org.in/scripts/bs_viewcontent.aspx?Id=4235).

RBI’s decision arrived as cold shower to most Indian based traders that relied on prop firms company to obtain some sort of income. In a country where the per capita income is particularly low, prop firms represented a life changing opportunity for talented traders lacking the initial seed capital.

The RBI website also warned that “This list is not exhaustive. An entity not appearing in the list should not be assumed to be authorised by the RBI. The authorisation status of any person/ETP can be ascertained from the list of authorised persons and authorised ETPs.”.

PROP FIRMS BANNING INDIAN CLIENTS

Not all prop firms reacted equally to RBI’s decision. FTMO, probably as a preventive measure, decided to stop accepting Indian residents to comply with RBI’s decision. Other props, included in the list, like FundedNext decided to simply ignore RBI’s decision and to this date (14th December 2024) still offer their service to Indian Resident.

FTMO decision to stop offering services to India was surely the saddest moment for many traders, that viewed in FTMO as the safest and most prestigious company in the prop space. Many Indian traders perceived that RBI decision was actually impacting their future negatively, not allowing them to fight for their financial independence and to build a more prosperous future for themselves and for their families.

WHAT PROP FIRM CAN I USE IF I AM INDIAN RESIDENT?

If you are currently residing in India you still have many options as a trader. If you are interested in Forex and CFD trading, there are still many prop firms offering their services in India.

The5ers (with a Trustpilot of 4.9) is a very reputable and beloved prop company that is not included in RBI’s list and is still offering it’s services to Indian residents. This firm is particularly suitable for traders wanting to use EAs without the need to provide much explications to the firm. The firm does however have some restrictions about using multiple IP addresses (please read this article on the topic).

Another big prop firm which is not included in RBI’s list is Alpha Capital Group (ACG). This is still one of our favourite choice since it allow trading form different IP addresses. Although they do have some restrictions about EAs implementing specific trading strategies, or about using trade copiers, they do not pose any issue if you are using utility EA (like our risk & emotions manager).

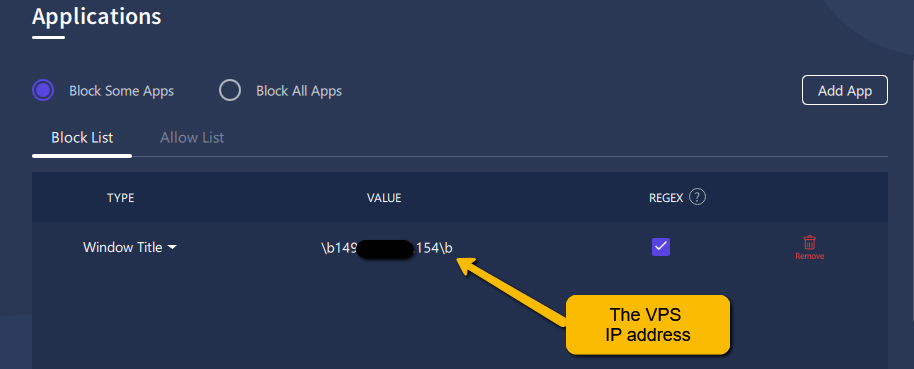

I personally use ACG with EmoGuardian running on a VPS server and I trade manually on my personal PC (read more about this custom solution here)

WHAT WILL BE THE FUTURE OF INDIAN TRADERS ….

Although at this stage it’s tough to forecast the evolution of the prop firm industry, one thing caught our attention. In RBI’s list there is no mention of any trading platform to trade futures (such as Nijatrader, TradeStation, VolFix etc…). This is probably a sign that futures, being a centralized market, is not a big concern for the Indian Regulator.

Another sign for optimism is that no prop firm for future (TopStep, ApeX, Earn2trade etc…) is mentioned in RBI’s blacklist. Traders can thus rely on these firms to grow their trading careers in a more regulated space.

We believe that, in the forthcoming months / years, if RBI’s perception toward CFDs and Forex does not change, the Alert list (link) might be updated with even more CFDs prop firms, whereas propfirms for futures-trading will be ignored by the regulator.

You might also want to read this article: