Saving your Funded Account

How many Challenges have you lost over the years? Maybe you passed some Challenges and then lost your funded account in matter of days/weeks. What was the reason for losing a Challenge or the funded account? … if I had to take a guess, most of the time you lost your account for hitting the maximum daily loss. This is quite astonishing and you should take responsability for this.

For most prop firms the Maximum Daily Loss is set at 5% of the initial account balance and losing 5% in a day is something that no professional trader will do. There are really no excuses to lose 5% in a single day. If you did not violate the Maximum Daily Loss, another common mistake for losing an account is over risking on single trade, overleveraging or overtrading. Let me show you how you can use EmoGuardian to protect your prop firm accounts and have a safe and smooth journey as a funded trader:

The Maximum Daily Loss

This is the risk management rule that traders violate the most. Violating the Maximum Daily Loss, for most firms, means losing the evaluation or the funded account. EmoGuardian allows to impose a max daily loss limit, by imposing a Max Daily Loss on Emoguarding smaller than the one required by the prop firm, you can make sure you will not violate the prop firm risk rule. Make sure to leave enough safety margin to compensate for slippage and spreads, since these will affect the market orders to close the open positions.

Mandatory Stop Losses

Some prop firm might require you to always have stop loss in place to protect an open position. You are normally given some seconds to insert a stop loss after you open a position. EmoGuardian allows you to automatically add a stop to your open positions stops can be set both in percentages of the initial balance and in pips value.

Overleveraging

EmoGuardian allows to specify a max volume per position and a maximum volume per open positions to avoiding over leveraging. If you need to customize the maximum volume per each symbol, reach out to us so that we can explain how to do so.

Overtrading

You can avoid overtrading by simply imposing a maximum number of trades per day. You can only devide your trading day into several time ranges and assign a max number of operation per each time range.

One-side bets (gambling warnings)

To avoid being flagged as a gambler and to avoid violating the Forbidden Trading Practices that many prop firms explain in the Terms and Conditions, you can use the Max Risk Per symbol. This is an amazing feature that will make sure that you do not violate the risk parameters that a prop firm (implicitely) enforce. You might be interested in reading this article, about the 1% risk rule.

Using EmoGuardian

EmoGuardian was originally developed to help myself, as a full time trader, improve my trading results. My previous EA was soley focosed on limiting the daily loss but, over time, I realized that I needed something more to reach consistency. So I developed EmoGuardian as a complete framework to set risk parameters to my trading account. Emoguadian, not only offers a variety of risk parameters but it also does an extensive preliminary check before allowing to set these parameters, to make sure that these are consistent. It also keeps logs of the parameters in use and of the operations performed, this helps the trader revise when some risk limit were triggered.

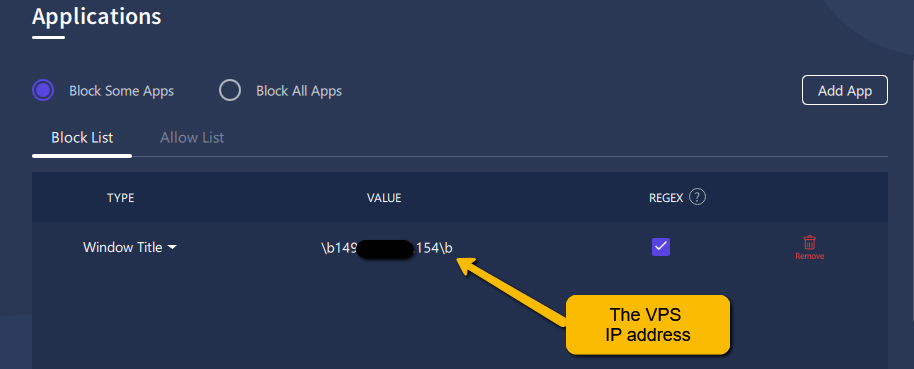

The best way to use EmoGuardian is in conjuction with a productivity software (I personally use FocusMe). Although the best solution would come from using a VPS you can also just implement the solution locally:

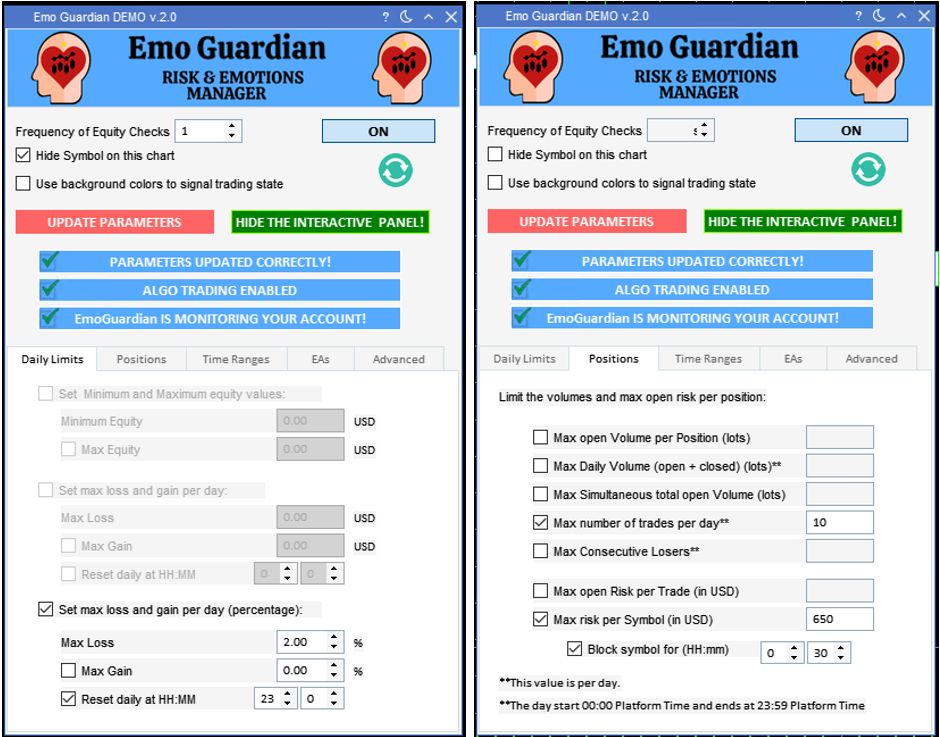

Example for prop firm use:

The image above shows a possible set up for using EmoGuardian with a propfirm. The trader impose a 2% maximum daily loss, which is far away from the 5% maximum daily loss that the prop firms allows. He then sets 10 maximum trades per day and a maximum risk of 650USD per symbol. Using these parameters the trader is protected against overtrading, against over risking and against any violation of the Maximum Daily Loss.

EmoGuardian use Cases

These are some “case studies” of how to use EmoGuardian.

Besides being useful in one’s personal trading account,

EmoGuardian is the perfect tool for a prop firm trader.

Emotions Management

Learn how EmoGuardian can be use to tackle the most common emotional behaviors that jeopardize a traders career

The 1% prop firm rule

Many Prop Firms are now enforcing a max risk per trade rule. Learn how to avoid risk warnings using EmoGuardian

Boom and Bust traders

Learn how to stop the vicious boom and bust cycle and grow your trading potential

Prop Firms application

EmoGuardian is perfect to avoid violating the risk management rules imposed by propfirms.

Darwinex case study

Learn how to grow your Darwinex Zero multiplicator by setting up the correct risk parameters in EmoGuardian

EA management

Learn how to use EmoGuardian to manage EAs and avoid losing accounts in case of EAs malfunctioning.