The Boom and Bust Cycle

In the last few months many prop firms have forced traders to adopt some specific risk management rules. Many traders have reported being denied a funded account, a payout or even being banned alltogether after the prop firm analyzed their risk management.

While in the past you could “easily” obtained a funded account by taking some huge risk trades, this is nowadaways unfeasible. Years ago, traders used to gamble their Challenges in one big trade, if the trade worked out they passed to the next phase, if not they would only lose their initial fee. Some traders, stacked up tens of Challenges and would eventually pass some of them.

This behaviour was obviously not a professional approach towards trading, but it still allowed traders to make some huge profits. In an attempt to discourage this reckless trading style, and to discourage gambling approach, prop firms are now taking measures and enforcing some specific risk rule. Most prop firms require to risk less than 1% or 1.5% per trade. This rule is often not, explicitely stated, for marketing reasons, but it might be enforced by the prop firm after any risky strategy is detected.

How does it work? How is it enforced?

There no standard way to enforce this rule, and each prop firm adopts his own internal policy. However most of the time, the procedure is a variation of the following steps:

-

- After a trader completes one or more steps of an Evaluation, a software is run to check if any trade exceeded some risk parameters. Namely no trade must have incurred in a risk greater than 1% (or 1.5%, or 2% depending on the firm). This is normally done by evaluating the open exposure of the trade, or multiple trades that are conceptually perceived as the same “Trade Idea”. For instance, a single open position on NQ with an open loss of 4% would trigger a warning.

A trader has 4 lots on NQ, the combined position creates a floating loss of 1%, the trader closes half of the position (0.5% risk), the rest of the position (2 lots) moves against the trader generating a loss of 0.8%, trader closes half of the position (0.4%), the rest of the position again goes against the trder and generates a floating loss of 1%. The overal open risk of this “Trade Idea” is considered 0.5% + 0.4% +1%=1.9% and it will probably trigger an internal warning in most prop firms risk system.

- After a trader completes one or more steps of an Evaluation, a software is run to check if any trade exceeded some risk parameters. Namely no trade must have incurred in a risk greater than 1% (or 1.5%, or 2% depending on the firm). This is normally done by evaluating the open exposure of the trade, or multiple trades that are conceptually perceived as the same “Trade Idea”. For instance, a single open position on NQ with an open loss of 4% would trigger a warning.

-

- After one or more warning are internally triggered by the risk detection sofware, the prop firm might contact the trader and send an “official warning”. Sometimes, depending on the gravity of the risk adopted by the trader, the firm might decided to simply monitor the traders’ risk management and postpone reaching out to the trader himself.

-

- If the trader receive an “Official warning”, he will be formally requested to adop a risk management strategy to keep using the prop firm service. Failing to do so, might result in one or two more warnings before the company taking some additional measures.

Measures taken after the “Official Warnings”

Every prop firm might enforce the warnings differently. By collecting the experience of many traders, we can list these measure:

A) mildly risky trader: risk above 1,5% in one ore two occasions and not deliberatley gambling accounts

-trader will normally receive at least two warning asking to adopt a 1% risk per trade idea

-if trader violated the Official Warning, the prop will ask to repeat the Evaluation

-if the trader keeps violating the risk parameters the prop firm might ban the trader

B) risky trader: risk above 1..5% in several occasions and accounts

-trader might receive only one warning pointing out the severity of the risky behavior detected

-trader will be requested to immediately reassess the trading strategy

-if trader keeps risking more than requested, the prop firm might immediately ban the trader

-depending on the prop firm the Evaluation cost might be reimbursed

-in most caCses, the trader will not be allowed to use the prop firm again in the future

C) extremely risky behavior detected and clearly target to gamble accounts

-in this case the case might immediately ban the trader with or without the reimbursement of the initial fee

-the trader will lose the possibility to use the prop firm services forever

Why you should care

Losing the possibility to trade with a given prop firm, should be considered a serious issue for a trader career. In 2023 and 2024 tens of prop firms went out of business.

This left the traders with only a bunch of trustworty firm, that are consistently paying payouts and that have the financial ability to pay big payouts. Some firms have a maximum capital allocation of “only” 100K per trader, which is not a big enough sum to allow traders to trade professionally.

Avoiding being “labeled” as as gambler or risky trader, should be a priority for every serious trader.

Without any tool to manage risk, an emotional day could lead the trader to adopt a risky behaviour and to jeopardize a relation with his favorite prop firm.

Using EmoGuardian

EmoGuardian offers a very useful feature to avoid breaching the 1% rule. The “Maximum Risk Per Symbol”, found in the section “….” allow to impose a maximum risk per open position on a given symbol.

The risk is computed on a flat by flat basis. Until a position is not fully flattened the risk will keep track of the previous partial closure of the position. Please check the examples below

Example 1:

Trader open 6 lots on NQ and sets a Max. Risk per Symbol of $1000.

When the trade generates an open (floating) loss of -$600 the trader closes half of the position, that is it will record a close loss of -$300, and keep the rest of the position open.

Tw an open position of 3 lots on NQ, the position has an open loss of -$300. After some minutes, the market move rapidly against the trader and the accrued loss is now -$450.

The trader now closes 1 lot, materialiazing a los of -$150. And keeps 2 lots still opened with a floating loss a -$300.

At this stage EmoGuardin registers that all the closed and current open positions generated an accrued Risk per Symbol of -$300 (closed position) -$150 (closed position)-$300 (floating loss).

After one hour, the open position on NQ (2 lots), further moves against the trader, generating a total loss of -$550.

EmoGuardian, will then consider that this “Trade Idea” genearted a total risk per symbol of -$1000. And will automatically close all positions.

For a $100K prop firm account, this will ensure that the trader will not violate the 1% rule, imposed by most prop firms.

Some firms might even consider that, even after all open positions on a given symbol are completely flattened, if a position is opened few minutes after, this is still to be considered as part of the original trade idea.

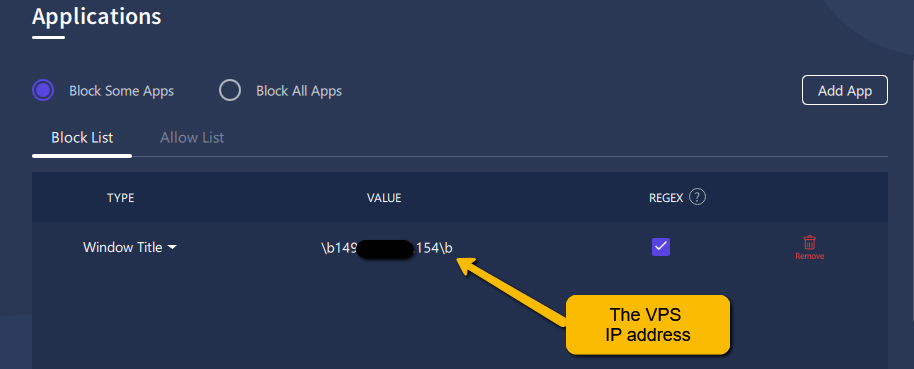

In this cases, it might be useful to completely block any additional trade on the symbol for several minutes. The subsection “Block symbol for (HH:mm)”, allows to to that.

To understand how to enfoce these limits, by using a VPS server, we have developed a separate tutorial, that can be read at this link, or you might check this YouTube video.

EmoGuardian use Cases

These are some “case studies” of how to use EmoGuardian.

Besides being useful in one’s personal trading account,

EmoGuardian is the perfect tool for a prop firm trader.

Emotions Management

Learn how EmoGuardian can be use to tackle the most common emotional behaviors that jeopardize a traders career

The 1% prop firm rule

Many Prop Firms are now enforcing a max risk per trade rule. Learn how to avoid risk warnings using EmoGuardian

Boom and Bust traders

Learn how to stop the vicious boom and bust cycle and grow your trading potential

Prop Firms application

EmoGuardian is perfect to avoid violating the risk management rules imposed by propfirms.

Darwinex case study

Learn how to grow your Darwinex Zero multiplicator by setting up the correct risk parameters in EmoGuardian

EA management

Learn how to use EmoGuardian to manage EAs and avoid losing accounts in case of EAs malfunctioning.