Darwinex application

In the last few months many prop firms have forced traders to adopt some specific risk management rules. Many traders have reported being denied a funded account, a payout or even being banned alltogether after the prop firm analyzed their risk management.

Darwinex Zero is a revolutionary business model that allow trader to obtain capital once they prove a trading track record. Darwinex allows you to trade on a demo account and prove your performance. You trading style is constantly monitored and an automatic system (called the Engine) decides how good your performances are compared to other traders. Based on how good your performances are and on your trading style you get assigned more or less trading capital. Besides that Darwinex trading engine will associate a multiplier to your account. The multiplier will increase/decrease the size of your trades, when these are replicated to the investors’ accounts.

Traders are then paid a commission of 15% of the profits generated on the investors accounts.

Using EmoGuardian to increase the multiplier?

Although Darwinex might seem the perfect tradeoff between trading on your personal account and trading with propfirm money, the truth is that if your trading style is not “coherent” according to the parameters of the Darwinex Zero engine, you might be assigned a very small multiplicator. For instance with a multiplicator of 0.2 if you made a 5% on your Dariwinex, you would only made a 1% on the investors accounts and your total commission would be 0.15%. With a 30K allocation a 0.15% would be $45.

The question is, how to increase Darwinex Zero’s multiplicator?

Darwinex zero engine analyze the trader’s operations and extract some statistics from those. The stats are meant to analyze the traders consistency and how to replicate the trades on the investors’ account without taking too much risk for the investors and, at the same time, grant some return. DarwinexZero’s engine is the core of the whole Darwinex echosystem and, obviouslu there is some secrecy around how it really works. What we know for sure is that the engine does not like uncertainty. The engine cannot really understand a trading strategy that one day trade a 1 lot on Gold and the next day trades 7 lots on the same instrument. Also, the engine cannot understand why a trader might accept an open loss of $500 on a given trade and $3000 on another one.

This kind of variance is something that the engine, simply does not like. When the engine detects this kind of variance, to protect the investors, it cuts down on sizes by reducing the multiplicator abruptly.

Using EmoGuardian

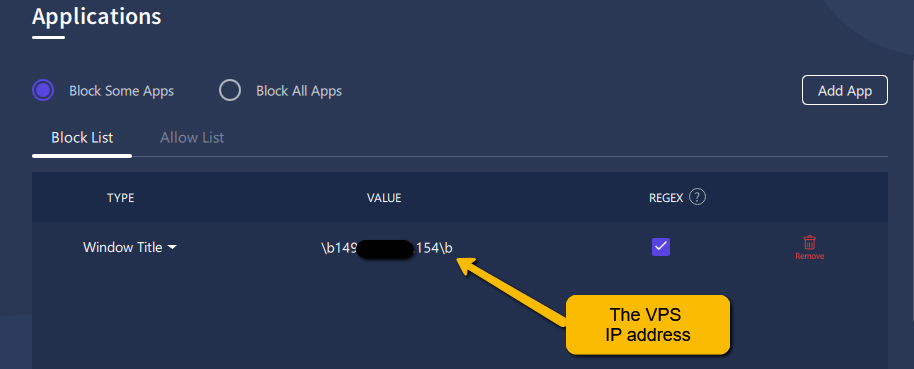

EmoGuardian offers some very useful features to maximize the multiplicator: you can impose a maximum lot size per position to make sure that all your trades are consistent in size. Besides you can also impose a maxim risk per trade or per symbo, which will also grant that your trading style is somewhat consistent.

Example 1:

Trader open 6 lots on NQ and sets a Max. Risk per Symbol of $1000.

This trader decided to impose several risk parameterrs to his trading account:

-a maximum open volume for position. If the trader opened a position bigger than 3 lots, EmoGuardian would immediately resize the position to 3 lots only. This would ensure that tradin is consistent in size, this consistency will increase the multiplier that DarwinexZero engine will associate to the Darwin

-The Max. simultaneous total open volume is an additional risk parameter to avoid over exposure.

-Maximum number of trades per day will ensure that the trading style is perceived as coherent by DarwinexZero Engine. If the engine detects overtrading it might consider this as a sign of risky trading behavior and flag the Darwin as risky. A risky trading style will correspond to a lower multiplier

-Finally the Max open risk per trade and the Max risk per symbol are also meant to assure proper risk management.

For a detailed explanation of Darwinex Risk Engine, we suggest reading this article.

EmoGuardian use Cases

These are some “case studies” of how to use EmoGuardian.

Besides being useful in one’s personal trading account,

EmoGuardian is the perfect tool for a prop firm trader.

Emotions Management

Learn how EmoGuardian can be use to tackle the most common emotional behaviors that jeopardize a traders career

The 1% prop firm rule

Many Prop Firms are now enforcing a max risk per trade rule. Learn how to avoid risk warnings using EmoGuardian

Boom and Bust traders

Learn how to stop the vicious boom and bust cycle and grow your trading potential

Prop Firms application

EmoGuardian is perfect to avoid violating the risk management rules imposed by propfirms.

Darwinex case study

Learn how to grow your Darwinex Zero multiplicator by setting up the correct risk parameters in EmoGuardian

EA management

Learn how to use EmoGuardian to manage EAs and avoid losing accounts in case of EAs malfunctioning.