Managing Emotions

Most trader, after an initila phase focused on technical analysis and market understanding, they soon realize that reaching profitability in trading has little to do with understanding the markets. Markets understanding, back testig strategies or developing indicators is just a tiny little factor for a successful trader.

The real difference between a profitable trader and a struggling one is emotions mangement. Usually a struggling trader, repeats some patterns that such us: adding to a losing position, increasing risk on a few trades, taking too many trades in a short amount of time, using a big part of the available leverage. All these behaviors end up jeopardizing the trader’s account and ultimately leaving the trader with no trading capital.

The sad part of being slave to your emotions is that, you will never be able to grow as a trader and explore your full potential. Dr. Robert Y. , CTO off a of a major U.S. broker, once said:

“Given the amount of technology that we have at our disposal, it’s disheartening to see how many trader do (literally) nothing to tackle their emotional patterns and to find a solution. “

The classic emotional behaviors

Let’s see what are some of the most common emotional patters that traders display and how EmoGuardian’s risk parameters can help traders tackle these behaviors:

1. Overconfidence: When a trader is over confident in his ability to read the market, he will probably take a huge amount of risk on one or few trades, believing that these trades have a 80% winning probability. This kind of probabilities, hardly exist in today’s highly efficient markets, and are often a calculation error made by the trader, rather than realistically assessed.

The risk associated to Overconfidence are twofolds, the obvious consequence is that the trader will take abnormal risk on some trades, that will evetually end up to be losers. These trades will create big losses that will destroy both the account, and the trader’s confidence on his/her trading abilities. Besides this ovious consequence, there is also another, more subtle consiquence which might further hinder the trader’s carreer. Many prop firms have an internal policy against “gambling behaviors”, whenever they detect that a trader gambles too much on a given operation (normally more than 1% or 2%), they will take some restrictive measure against the trader. If these behaviours are detected again the trader migh ultimately be banned from using the prop firm services. For more details on this topic, please refer to this article: “The 1% rule”.

This behaviour is easily fixed using the option “Max-risk-per Symbol” in EmoGuardian. This feature allow to only risk a certain amount on a given symbol and it takes into account multiple open positions on the same symbol Once the trade generates a los bigger than the established risk value, the trade will be closed. This feature resets the calculation only once all positions have been completely closed on the given symbol, thus preventing averaging down or other similar attempts to work around EmoGuardian control.

It’s also possible to block trading on that specific symbol for some minutes. Allowing the trader to avoid any compulsive behavior.

2. Revenge Trading: This is another classical emotional behavior of a trader. After a few losing trades, the trader cannot believe that he could have so many losses in a row and feels the urge to “be right”. In an extreme attempt to obtain some winning trades and recoup the losses, he will take compulsive trades. These trades are anything but based on market analysis and market understanding. The impulsive behaviours are governed by the trader’s pride and ego. When a trader falls prey to revenge trading he can literally loses and account in a matter of hours.

Revenge trading is an easy-fix using EmoGuardian. We have multiple features to tackle this issue: The Time-Ranges tab offer the possibility to impose max loss and a max number of trader for a given time range. For instance a trader might decide to allow himself to only lose $600 from 7am to 11am and to only take 5 trades in this time period. He can then allow himself to take a max of 10 trades from 11 am to 4 pm and 5 trades from 4pm to 11 pm. These limits are normally enough to impose some control on the trader’s emotional behaviours.

Another useful feature is the Max. Consecutive Losers or the Max number of trader per day. .. and of course the maximum daily loss, which is always a good risk management feature

3. FOMO: Fear of Missing Out is another classic emotions that all trader now or then succumb to. Pushed by FOMO traders tend to chase the markets in a compulsive way, trying to catch any possible move fearing to lose the “golden opportunity”. This often results in irrational decisions, that are not governed by rational analysis. FOMO is often rooted in some deeper psychological issues, such as the need of acceptance and the need to prove something to yourself and to others. Very often beginners traders dream of drastically changing their lives with trading. When trading is perceived as a “lottery ticket” for a better life, the trader fears that missing a trade might mean missing a life changing opportunity.

This resuls in overtrading or in sizing up to much on a single trade.

The features “Max Risk per Trade” and the limits on the “Maximum number of trades” per day or per time range are extremely useful to fight FOMO.

4. EUPHORIA: This emotional reaction is often underestimated, indeed it’s often a big cause for great losses and a powerful trigger for other emotions. After a big winning trade or a big winning trade, traders often start to believe that they are blessed by fortune… or, to use a gambling expressions, they are on a “hot streak”. They lower their guard and they stop managing risk properly. They often think that, since they already made a bunch of money for the day, they have the right to relax and stop caring about proper risk management. They size up and try to go for a “home run”: an incredible trade that can give a push to their trading career. The rationale behind this is that they are playing with the Casino’s money.

The “amazing trade” is a trade that (in the trader’s mind) has a 90% winning probability and a 6:1 risk reward. Traders seems to forget that markets are extremely efficient and this kind of trading opportunities rarely exist. When the trade result in a loss, revenge trading kicks in and a winning day can suddenly turn in a catastrophic day, wiping out weeks of tidy and rational trading.

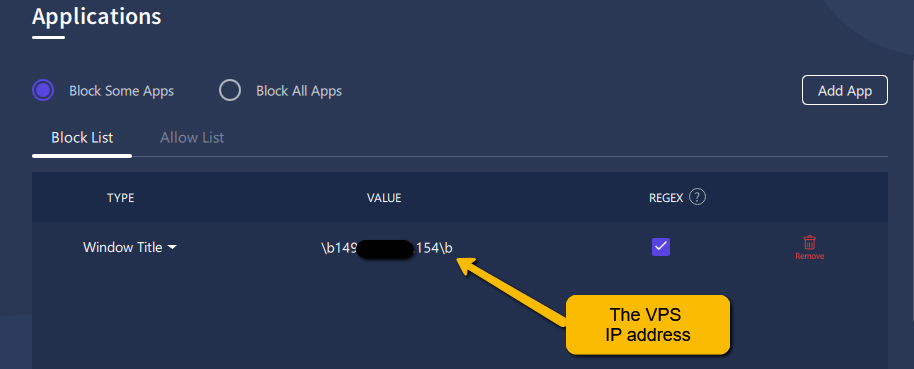

The easy solution to fight Euphoria is to recognize that we all have a financial blueprint, above a certain daily gain, we become emotional and we are no longer rationale and professional traders. Fixing a maximum gain per day using the Daily Limit tab in EmoGuardian is a quick fix to fight Euphoria. By installing EmoGuardian on a VPS server and blocking the access to the VPS server using a productivity tool, once the maximum gain per day is reached, EmoGuardian will immediately flatten all the trades that are taken on the account.

5. Other Emotional Triggers: A part for the emotional reactions described above, as a trader you will often recognize that there are some triggers that go off for a variety of reasons. Sometime interference outside trading can create a dangerous emotional state, which can prevent us from trading as we would like to. Once we recognize one of these triggers the best thing to do is to stop trading for the day. This is often easier said than done.

EmoGuardian has a great feature that allows you to create an Emergency Signal, this can be a combination of symbol+volume or a comment+ volume. Once the emergency signal is created EmoGuardian will flatten all trades and prevent all new trades until it’s reinstalled or the risk parameters are updated.

If a trader detects a potential emotional trigger, he can simply create the emergency signal. For instance if you normally do not trade Dogecoin or Cocoa you can set the emergency signal to be a position with Volume 0.03 on DogeCoing/USD or 0.11 on Cocoa. Once you open such a position, EmoGuardian will flatten al existing trades, kill all EAs and flatten immediately any trade you might take. Fore more details on how to use Emergency Signals, please refer to the manual at this link: https://www.mql5.com/en/blogs/post/753194

Using EmoGuardian

EmoGuardian offers a variety of features to fight against emotional behaviors. Each trader should know his weaknesses and set up EmoGuardian risk limits accordingly. In my experience, setting a maximum daily loss and a maximum risk per symbol (or per trade) is must. Although we often think that all trades are incorrelated, we are not robots and every day we wake up with a different mental state. By imposing a maximum loss per day, once this limit is reached we will have to stop trading for the day and wait until the next day to trade again. This is often enough to reset our mental state and start fresh with a different attitude.

Example:

The picture shows a possible solution used by a European trader. His broker times are expressed in CET and this is the time taken as a reference by MT5 and EmoGuardian.

The trader decides to divide his trading day into thre time ranges, one starting at midnight CET until 8 am CET, this timeframe covers the “overnight trades” that are taken before the standard opening of the European stock markets (Dax, Ibex, Cac40 etc..). The trader decided that he is allowed to only lose 600€ in these overnight trades. Then during the European session and before the US market open (that is from 8 am CET to 3:29 pm CET) he allows himsef a total los of 1000€ and only 6 trades. If these limits are reached EmoGuardian will flatten any additional trader for the following 2 hours.

Finally he decided to allow a total loss of 1500€ for the US session, starting at 15:30 (3:30 pm CET) until 22:30 (10:30 pm CET).

This solution is a clever way to mange emotions and, at the same time, allow enough room to recover from any emotional situation. By dividing the day in 3 session the trader, EmoGuardian will block the trader if overtrading kicks in during the morning session and allow him to trade again in the US session once his emotions are under control.

EmoGuardian use Cases

These are some “case studies” of how to use EmoGuardian.

Besides being useful in one’s personal trading account,

EmoGuardian is the perfect tool for a prop firm trader.

Emotions Management

Learn how EmoGuardian can be use to tackle the most common emotional behaviors that jeopardize a traders career

The 1% prop firm rule

Many Prop Firms are now enforcing a max risk per trade rule. Learn how to avoid risk warnings using EmoGuardian

Boom and Bust traders

Learn how to stop the vicious boom and bust cycle and grow your trading potential

Prop Firms application

EmoGuardian is perfect to avoid violating the risk management rules imposed by propfirms.

Darwinex case study

Learn how to grow your Darwinex Zero multiplicator by setting up the correct risk parameters in EmoGuardian

EA management

Learn how to use EmoGuardian to manage EAs and avoid losing accounts in case of EAs malfunctioning.